child tax credit portal update new baby

Already claiming Child Tax Credit. They could also use the portal to sign up for advanced payments of the child tax credit.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

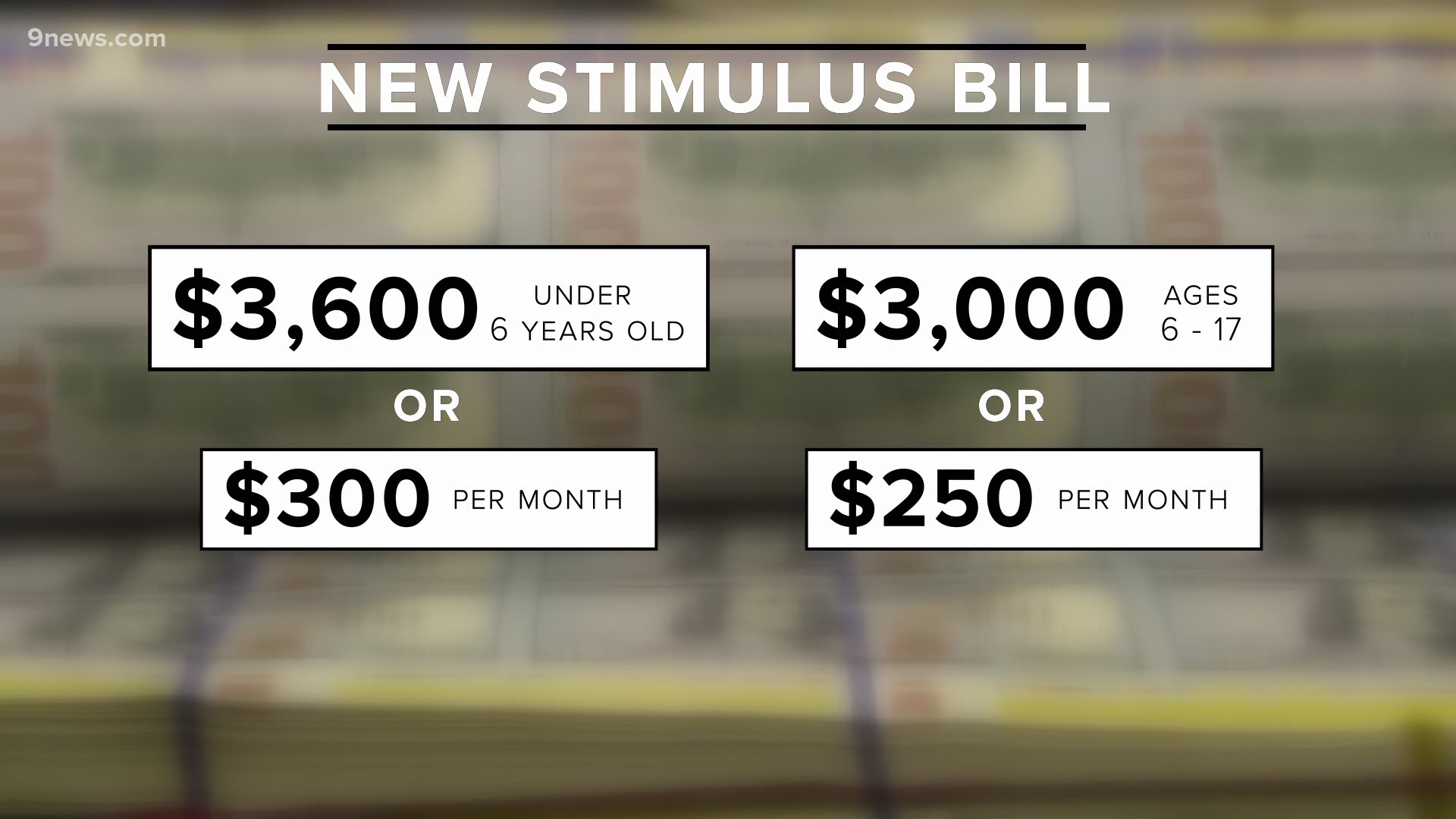

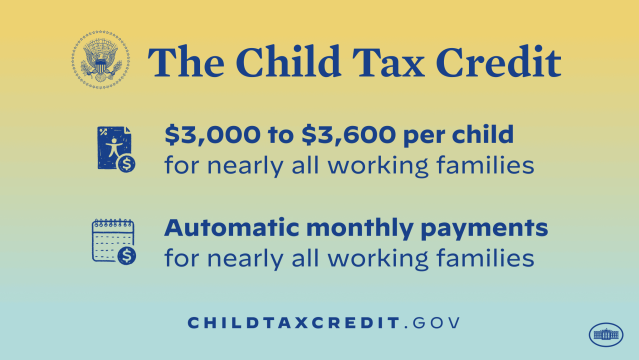

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income.

. Your amount changes based on the age of your children. Child Tax Credit Update Portal. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children ages 6 through 17.

Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit. The IRS has promised to launch two online tools by July 1. You can also refer to Letter 6419.

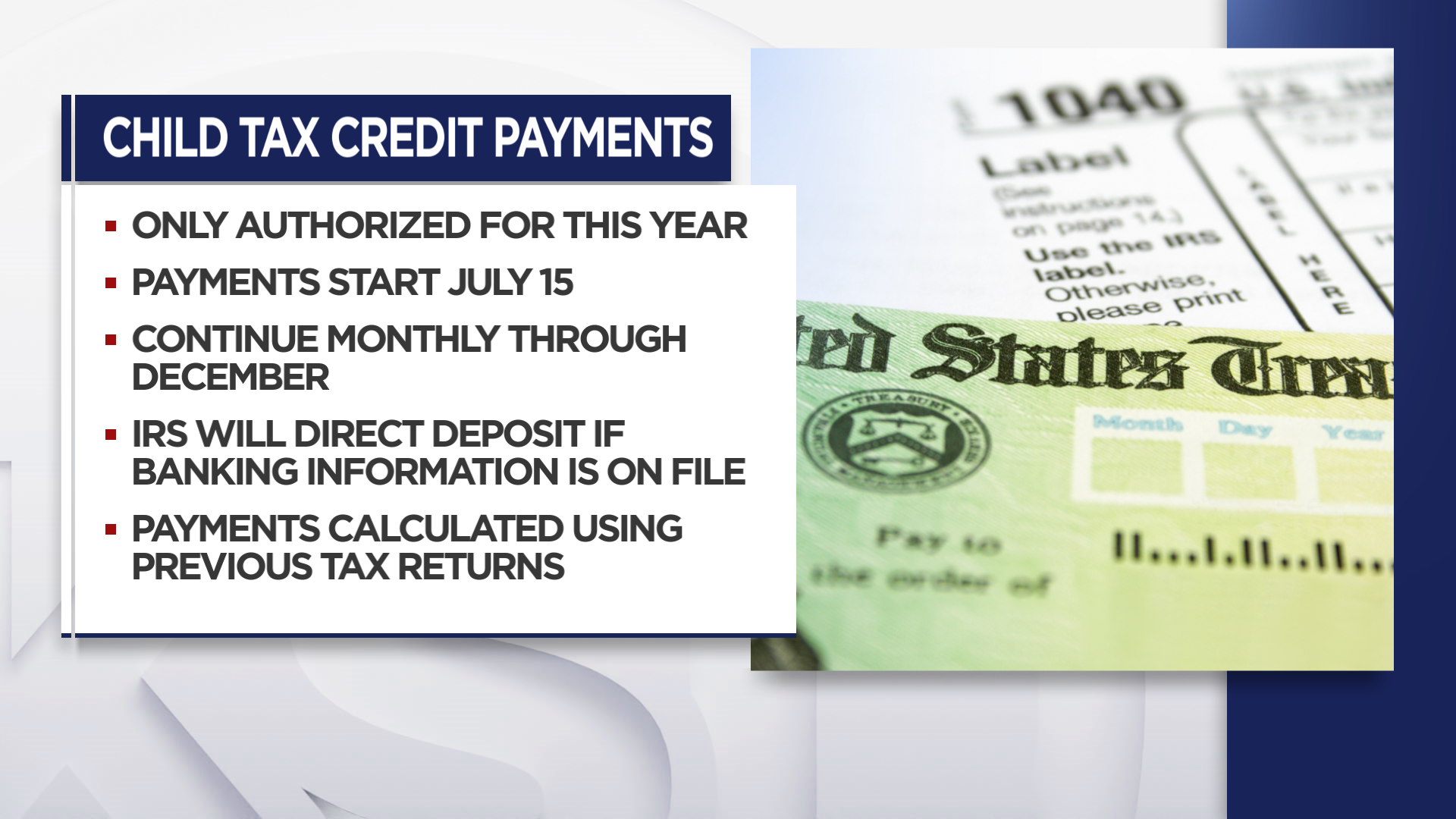

The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct check payment status and unenroll from the. Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not eligible for the credit. This portal was set up in June 2021 and closed at the end of the year.

Tax credits for childcare while you work. Determine your filing status with the Interactive Tax Assistant. That means that instead of receiving monthly payments of say 300 for.

Up to 2005. To reconcile advance payments on your 2021 return. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal.

Claiming Dependents and Filing Status. The amount you can get depends on how many children youve got and whether youre. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week.

That means you will start getting a monthly advance probably in November if you do it now. According to the IRS one of the planned enhancements for the Child Tax Credit Update Portal will enable parents to add children who are. Enter your information on Schedule 8812 Form 1040.

But no matter what month your child was born in 2021 you get the ENTIRE tax credit for the year. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17. Here is a direct link to the portal that lets you sign up to adjust your child tax credit and in your case add a newborn.

Get your advance payments total and number of qualifying children in your online account. Up to 12250 a week 1 child Up to 210 a week 2 or more children You will not get 100 of your childcare costs. Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid.

How much will you get. How much is the child tax credit worth. One portal will allow families to update their details adding dependents and income changes throughout the year.

Child Tax Credit Changes. Child tax credit 2022 New 350 monthly family stimulus checks would be deposited directly into accounts under plan Why some parents were only paid half their child tax credits Last child tax credit payment amount explained. If you dont get them started you will receive the entire credit on your 2021 tax return.

This secure password-protected tool is easily accessible using a smart phone or computer with internet. As part of the American Rescue Plan the IRS will begin issuing the 2021 Child Tax Credit monthly payments beginning on July 15. Making a new claim for Child Tax Credit.

Child tax credit continued. July 4 2021. Find out if you can claim a child or relative as a dependent with the Interactive Tax Assistant.

Do not use the Child Tax Credit Update Portal for tax filing information. For every family earning 125000 or less the child tax credit covered 50 percent of qualifying expenses up to 8000 associated with the care of a child under 13 or a spouse parent or other dependent who is unable to care for themselves. Families who are expecting a baby to arrive this year can also claim the child tax credit cash.

The advance Child Tax Credit payments which will generally be. File Form 8332 ReleaseRevocation of Release of Claim to Exemption for Child by Custodial Parent. The payment for children.

June 28 2021. In a recent press release the Ways and Means Committee provided information on the long-awaited online portals to register for the child tax credit benefit. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year.

The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. To get the credit this year you can go to wwwirsgov and go to the Child tax payment update tool and add the child and start the payments coming up soon. To complete your 2021 tax return use the information in your online account.

Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments.

StockRocket Getty ImagesiStockphoto. This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. The IRS created a Child Tax Credit Update Portal where families could add more dependents and report any other changes.

The advanced payments were only for July through December 2021.

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Irs Child Tax Credit Payments Start July 15

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wbff

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit Payments How Should You File Your Taxes Marca

The Big Increase And More Changes To The Child Tax Credit In 2021

Child Tax Credits 2021 What To Do If You Don T Get Your Payment Today

New Child Tax Credit Explained When Will Monthly Payments Start 11alive Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News